How to Recover Failed Payments for Online Courses

With all the benefits of multi-payment plans, making them available to your customers seems like a no-brainer.

In case you need a refresher, multi-payment plans are magical for both you and your customer because they:

- Allow you to broaden your audience with a more flexible payment option

- Let customers pay in smaller, more digestible increments for convenience, affordability, and attainability

- Make advertising and promotion more effective

- Give you consistent cash flows for sustenance after a launch

- Align with your business’s core values if those include affordability and inclusivity

- Help you make a *little* more money than with an in-full payment

They get a flexible payment option, you get multiple revenue streams on a consistent monthly basis. Total win, right? That is, assuming you actually receive those payments.

But here’s the rub (I know, why is there always a catch??) – with multi-payment plans there’s always a risk of failed payments.

*Cue Rihanna’s halftime show opening song* (you know the one).

Jokes aside, a failed payment can be very awkward and uncomfortable for both you and your customer. Your initial reaction could be to send one of those kindhearted emails where you overthink every bit of punctuation and have your go-to email vetter read it over before hitting send (Not just me, right?)

I’m going to let you in on how TSB used to handle this super awkward situation:

- We received an email that a payment failed…womp, womp.

- We manually wrote and re-wrote an email reaching out.

- 🦗 Crickets…

- We manually wrote email no. 2

- We received an odd non-committal response or explanation

- Attempted a supportive and understanding approach

- 👻 Got ghosted…

- We tried a third time with a slightly firmer email

- Give up and keep fingers crossed it doesn’t happen again

Needless to say, this is a ton of manual work, hours wasted, and energy spent for zilch results.

And you guessed it, it undoubtedly happened again. Not only is it part of the risk of accepting flexible payment plans, it’s to be expected.

At TSB we had to give this process some serious TLC so that it aligned with all of our other touchpoints by being thoughtful, strategic, boundary-setting, but above all else, compassionate.

So, here’s how we zhuzhed our plan for failed payment recovery:

When overdue by one day:

- A pre-made email within our checkout software (ThriveCart) automatically deploys.

This allows customers to resolve the issue quickly thanks to the prompt notification. Plenty of times it’s just a change-the-card-on-file sitch.

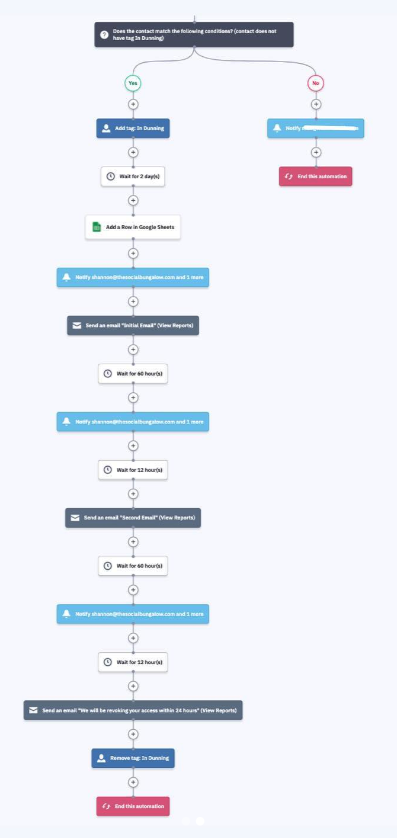

When overdue by two days, the system gets busy:

- A Zap (using Zapier) is created which adds the customer to two files – a tracking spreadsheet and another pre-made automation in ActiveCampaign (the email marketing software we use *that link is an affiliate link, if you sign up for AC using it I receive a small commission.)

- The ActiveCampaign sequence deploys with each message sent 60 hours apart:

- Email 1: Heads Up! + How Can We Help?

- Email 2: We Tried Again, Let’s Chat!

- Email 3: We’ll Be Revoking Your Access in 24 Hrs (but we’re here if you want to resume payments & access!)

- If a payment is made, we are notified via email and we remove them from the remaining ActiveCampaign emails

- We keep the spreadsheet on file so that we can have a manual report as well

Here’s what this automation looks like in our ActiveCampaign:

We hold on to our list of customers who had delayed or failed payments exclusively for internal tracking. If we notice repeat occurrences we may reach out to the customer to discuss adjusting the payment plan or even use this information to consider the pricing, payment options, and processes for other customers and further refinement of the company.

Getting paid for our offers is important, but that doesn’t diminish the importance of meeting our customers’ where they are – it’s the whole reason we all do what we do!

Side note: Saved payments using this structured and caring approach have increased by 120%.

Any questions? DM them to me on Instagram. That’s where I hang out!

*The one ActiveCampaign (AC) link found in this blog is an affiliate link. Which means if you choose to sign up for AC using the link I’ll receive a small commission. I only recommend tools I use & love, and AC is my top recommendation for email marketing.

Subscribe to The Goods, a free newsletter that brings the online business heat each and every Tuesday 🔥 #getthegoods

Related Posts

Check This Out

The Goods is your weekly download of all things business scaling and magnetic marketing, from exclusive content by Shannon to incredible guest contributors. We’ve got what you need.